YOUR NEW TANKLESS WATER HEATER MAY BE ELIGIBLE FOR UP TO $600 FEDERAL ENERGY TAX CREDIT

Non-Business Energy Property Tax Credits have been retroactively extended back to January 1, 2019, through 2032.

Good news! The Non-Business Energy Property Tax Credit has been extended through 2032 and made retroactive to cover 2020. The credit amount for Gas, Oil, Propane Water Heaters, including tankless units, is $300.

That means if you installed a qualifying tankless water heater last year, you could get the credit on the return you file in 2023 (for 2022). Of course, any qualifying tankless water heater installed this year would also qualify on taxes due in April 2024.

Here is how it works:

Residential equipment and materials that meet specific standards set by the Department of Energy can qualify for the Equipment Tax Credits for Primary Residences. However, these credits apply only to existing homes and a principal residence. Newly constructed homes or rentals are not eligible.

For this credit, the IRS distinguishes between

Qualified Energy Efficiency Improvements and Residential Energy

Property Costs. “Water Heaters (non-solar)” are a part of Residential Energy Property Costs. All Energy Star-certified tankless water heaters meet the requirements for the Non-Business Energy Property Tax Credit.

According to Energy Star, water heaters account for 12% of the energy consumed in the home. Energy Star® is the government-backed symbol for energy efficiency, providing simple, credible, and unbiased information that consumers and businesses rely on to make well-informed decisions.

Here’s what you need to know before you apply:

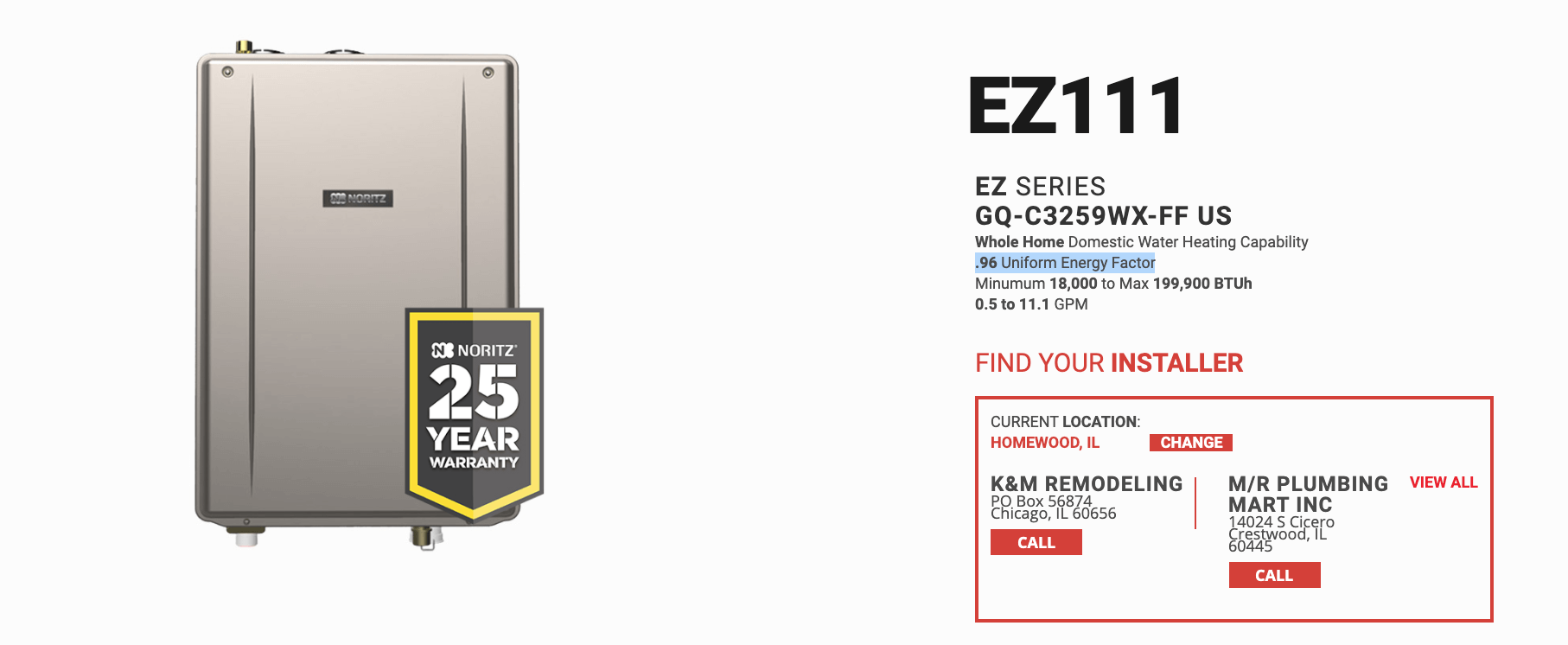

1. Does your tankless water heater have a Uniform Energy Factor (UEF) of 0.95 or above?

UEF (Uniform Energy Factor) is the newest measure of overall water heater efficiency, according to the Energy Star website.

To qualify for the Residential Energy Property Costs Tax Credit your tankless water heater must have an energy factor (overall efficiency) of 0.95 or more. The UEF of your tankless water heater is an important consideration when you’re in the process of purchasing a residential tankless water heater, or hoping to apply for the tax credit.

Most Noritz residential tankless water heaters are Energy Star-certified, but be sure to check your model’s spec sheet or technical information to confirm whether it qualifies. You can also find your residential tankless water heater’s UEF on the Noritz products page by clicking on your model.

2. Do you have your Manufacturer Certificate?

To apply, you will need a written certificate that your tankless water heater qualifies for the tax credit. You can download the certificate as a PDF right from our Rebate Center page, which can help you find the best rebates available in your area on qualifying models.

As soon as the IRS announces an extension of the tax credit, manufacturer certificates are updated and made available on our website